Crowdfunding for business has become a popular way for founders to raise capital and bring their ideas to life. It allows individuals or businesses to reach a large audience of backers and secure funding for their projects through online platforms.

Whether you’re just starting out or have an established business, you can leverage crowdfunding to achieve your business goals. Among other things, you can use a crowdfunding campaign to test new ideas, build organizational capacity, or expand your operations.

But before we dive into how to use crowdfunding for business, let’s lay out the phases of your business lifecycle.

The Business Lifecycle

The business lifecycle refers to the various stages that a business goes through from inception to its eventual end. The stages are commonly defined as:

- Idea/Development: This is the initial stage of a business where the idea is conceived, and a plan is formulated for the business. It may include market research, product development, and creating a business plan.

- Startup: As a startup, your business is officially launched and operations have begun. The focus of this stage is on generating revenue and establishing a customer base.

- Growth: Once the business has established itself, it enters the growth stage. This stage is characterized by an increase in revenue, expansion of operations, and hiring of additional employees.

- Maturity: At this stage, the business has reached its peak in terms of growth and revenue. The focus shifts to maintaining market share, improving efficiency, and maximizing profitability.

- Decline: Eventually, all businesses reach a decline stage. Revenue and profits begin to decline due to market saturation, changing customer preferences, or other factors.

- Renewal or Exit: At this stage, the business can either go through a renewal process or exit the market altogether. This involves revamping the business model, acquiring other businesses, selling the business, or shutting it down.

Each stage of the business lifecycle presents unique challenges and opportunities when crowdfunding for business. These are similar to, but distinct from, the challenges faced by nonprofits in their lifecycle, which we’ll get into in a different post.

But the beauty is: crowdfunding works at any stage of your business development. Let’s see how. 🎯

Crowdfunding for Business

Idea/Development Phase

Have you ever heard those old stories of the tech boom in Silicon Valley? A couple of bros in a bar write a business idea on a napkin and get a bunch of money from an angel investor.

Well, many people raise money on little more than a business idea every day. Crowdfund Your Dream’s founder raised $15K for her short film, and $35K for another business, as just ideas. (And she’s helped her clients do the same!)

Tons of product-based founders use crowdfunding to fund their first manufacturing run. At the end of the campaign, backers receive the product according to a pre-determined timeline. But take it from Nathan Resnick:

“With the uncertainty of scale on a crowdfunding campaign, you’re going to need manufacturers who can act fast and be prepared for bigger production runs than expected. If you really knock your crowdfunding goal out of the park, the right manufacturer will be happy to face the challenge of meeting this new demand.”

Nathan Resnick, The Four Essential Steps to Manufacturing Crowdfunding Campaigns

Though data shows that development fundraising is much tougher if you’re not white and male, it’s still possible. So this idea some founders have that you need to wait until you’re an established business is a myth. No, you don’t! You CAN raise money for business ideas/development.

Startup Phase

If you have a startup business, you’re in a great position to raise money. This means you’ve already established your business, have a prototype/beta offer, and are gaining traction in the market.

That can be an attractive prospect to backers if you can demonstrate strong interest from customers and a high rate of growth. In the absence of traction, if you’re able to tell a compelling story of your background, expertise, and how your business will transform the world, you can still have a great raise.

For creative professionals, like apparel designers or filmmakers, having a prototype—like a short, proof-of-concept film or a sample pair of shoes—is key to selling your vision to investors. If you’ve watched Shark Tank, then you’ve seen founders do this effectively before.

And don’t forget that you can also use the crowdfunding platform itself as a launch pad to bring your product, good, or business to market. Increasingly, product-based businesses are using Kickstarter for just that.

Growth

If you already have an existing business with an established market or audience you can use crowdfunding to grow. That includes raising money to build organizational capacity—like hiring a marketing assistant, web developer, strategy consultant, or operations director. This can also include establishing basic financial, marketing, and production systems that will allow your business to grow and scale effectively.

For instance, maybe you’ve got all your customer information in Google spreadsheets. But you need a robust customer relationship management system, like Salesforce or Active Campaign, to provide better service and take your business to the next level. You can raise money to fund that transition, including planned growth activities and initiatives in your story to funders.

But you need a clear growth plan to understand what parts of your business need funding and can yield the best ROI. There are tons of cautionary tales about businesses who funded growth initiatives that almost put them out of business.

For example, the story of Ample Hills:

“From 2015 to 2019, Ample Hills raised around $19 million to fund its ambitious expansion plans, hoping to conquer the $11 billion ice cream industry. The company went from a handful of stores in Brooklyn to 17 locations, including one in Disney World. But on March 15, the day before New York City shut down for the pandemic — and as signage bearing Ample Hills’ farm animal mascots and the words ‘ice cream coming soon’ was still up at a second Disney location — everything came crashing down. Ample Hills filed for Chapter 11 bankruptcy, just short of the company’s 10th anniversary.”

Courtney Rubin, The Shocking Meltdown of Ample Hills — Brooklyn’s Hottest Ice Cream Company

Decline

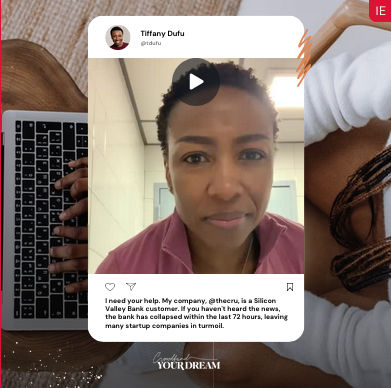

Here’s an aspect of crowdfunding for business that often doesn’t get enough attention—until it’s too late. And that’s raising money for a business in decline.

You’ve probably seen campaigns launched by founders desperate to prevent their doors from closing. Maybe you’ve even given to a couple of these campaigns.

They are ubiquitous on sites like GoFundMe and Kickstarter, but often the most difficult campaigns to run successfully. That’s because the business is already in dire straits, likely understaffed and underresourced, and thus beginning the campaign already at a deficit.

But for some businesses, with really engaged communities that can help amplify your message, launching a campaign to save your business can work.

For instance, take a look at how the investigative journalism outlet Texas Observer launched a GoFundMe campaign that raised $300K in a matter of days to save their newspaper from shuttering.

It’s far more common to see campaigns like this fail, however. For example, take a look at the GoFundMe campaign for beloved Brooklyn restaurant Amarachi.

The reason these campaigns struggle, apart from the issues raised above, come down to campaign design, strategy, and outreach. Well crafted campaigns with a compelling story, strong visuals, and a solid outreach campaign generally do better than others.

But when you launch a last minute desperate campaign, you’re throwing a lot of that out the window, relying on an audience of supporters to carry you over the finish line. If you have an engaged audience, however, it could work. But if not, you might find a campaign like this going nowhere fast.

Conclusion

In conclusion, crowdfunding for business growth can be a powerful tool at various stages of your business lifecycle. But it’s important to understand the caveats of raising money in each phase.

For early-stage startups, crowdfunding is great to raise money, launch, and generate buzz, but it’s important to have a compelling pitch to stand out in a crowded market.

Growth-stage businesses can use crowdfunding to fund expansion and reach new markets, but it’s important to have a clear growth plan.

For established businesses, crowdfunding can be a way to test new product ideas and engage with customers, but it’s important to be aware of the potential risks of crowdfunding, including the possibility of not reaching your funding goal or damaging your reputation if the campaign is not successful.

Overall, with careful planning and execution, crowdfunding can be a valuable way to raise capital, build brand awareness, and build your customer base.

What phase is your business in and what do you need to raise money for? Drop a comment below! If you need more background info on crowdfunding, read How Crowdfunding Works and Tips for Launching and Marketing Your Campaign.