Real estate crowdfunding is a relatively new way for investors to access real estate deals that were once only available to large institutions and wealthy individuals. The concept is simple: a group of investors pools their money together to invest in a real estate project.

These investors are typically able to invest smaller amounts of money than they would need to buy a property outright. And they can often diversify their investments across multiple properties or projects. In this blog, we will discuss how real estate crowdfunding works and the features of four leading real estate crowdfunding sites: CrowdStreet, Fundrise, PeerStreet, and RealtyMogul.

How Real Estate Crowdfunding Works

Real estate crowdfunding platforms act as intermediaries between investors and real estate developers. The platform typically sources real estate deals and performs due diligence on the developer and the property.

Over time, two different residential and commercial real estate crowdfunding models have emerged:

- Direct crowdfunding

- SPV-based crowdfunding

SPV-based Crowdfunding

In SPV-based crowdfunding, once a deal is approved, the platform creates a Special Purpose Vehicle (SPV) in which investors can invest. An SPV is a subsidiary, a private limited company created by a crowdfunding platform. It’s typically structured as a Limited Liability Company (LLC) or Limited Partnership (LP).

This legal entity is used to collect funds from investors and transfer them to a sponsor once the crowdfunding campaign is over. The raised funds are moved in a single transfer, so, for a sponsor, it looks like the funds were invested by one investor (an SPV).

For real estate crowdfunding platforms, an SPV means an opportunity to access a large number of small investors who would not be able to invest otherwise. A platform also gets subscription fees, administration fees, ongoing asset management fees, exit fees, and so on. That’s a lot of upside.

Direct Crowdfunding

In the direct real estate crowdfunding model, investors invest directly with an individual sponsor. The crowdinvesting platform doesn’t create an additional legal entity and thus, doesn’t bear additional expenses that would influence the return on investment otherwise.

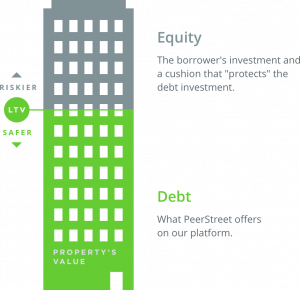

Equity vs Debt Investments

There are two main types of real estate crowdfunding investments: equity investments and debt investments. In an equity investment, investors own a percentage of the property and receive a share of the profits when the property is sold. In a debt investment, investors lend money to the developer and receive regular interest payments. Debt investments are typically less risky than equity investments, but offer lower returns.

Real estate crowdfunding sites typically charge fees to investors and developers. Investors may be charged an annual management fee, a performance fee, or both. Developers may be charged an origination fee and/or a servicing fee.

Now that we understand how real estate crowdfunding works, let’s take a closer look at four leading real estate crowdfunding sites: CrowdStreet, Fundraiser, PeerStreet, and RealtyMogul.

Four Top Crowdfunding Real Estate Platforms

Crowdstreet

CrowdStreet is a real estate crowdfunding platform that focuses on commercial real estate investments, such as office buildings, apartments, and industrial properties. It offers both equity and debt investments, and investors can invest in individual properties or in diversified funds.

One of the unique features of CrowdStreet is its Marketplace, which allows accredited investors to browse and invest in individual real estate deals. Investors can also invest in funds that are managed by CrowdStreet. The platform offers a range of fund options, including a Growth REIT, an Income REIT, and a blended portfolio. (REITs, or real estate investment trusts, are companies that own or finance income-producing real estate.)

CrowdStreet charges a 1% annual management fee for its funds and a performance fee of 20% for its value-add and opportunistic funds.

Fundrise

Fundrise focuses on individual investors and offers a range of investment options, including eREITs, eFunds, and individual deals.

eREITs are similar to traditional REITs but are sold directly to investors through the Fundrise platform. eFunds are private equity funds that focus on real estate investments. Both eREITs and eFunds offer diversified portfolios of real estate investments.

Fundrise also offers individual deals, which allow investors to invest in specific real estate projects. These deals typically have higher minimum investment requirements than the eREITs and eFunds.

Fundrise charges a 0.85% annual management fee for its eREITs and eFunds and a 2% origination fee for its individual deals.

PeerStreet

PeerStreet focuses on debt investments, such as short-term bridge loans for fix-and-flip projects, and longer-term loans for rental properties. The loans are sourced from private lenders and are vetted by their team to ensure they meet their underwriting standards.

PeerStreet give individual investors the ability to create diversified portfolios of real estate debt. Their loans typically have shorter terms than other real estate crowdfunding platforms. They range from six to 24 months for bridge loans and up to 36 months for rental property loans.

PeerStreet offers first-lien positions, which is senior debt on a property, sitting at the safest part of the capital stack. This position is the least risky because these investors will be the first in line to get paid, and take priority to junior debt and equity in the event of default or foreclosure.

But there can be multiple layers of debt on any property, like a second, or even a third lien. That order represents the priority order of the parties being paid back, of which equity is the riskiest position.

PeerStreet calls itself “The first two-sided marketplace for investing in real estate debt.” It delivers its unique value proposition by supporting investors, lenders, borrowers, and the communities they live in.

One of the unique features of PeerStreet is its “Automated Investing” tool, which allows investors to set investment criteria. Their investments are then automatically invested in loans that meet their criteria.

PeerStreet charges investors a 0.25% to 1% servicing fee on their investments, depending on the loan type and duration. And you only need $1000 to get started.

RealtyMogul

RealtyMogul is a real estate crowdfunding platform that offers both debt and equity investments. Investors can get in on commercial real estate investments, such as office buildings, retail centers, and apartments/multifamily properties.

RealtyMogul’s debt investments include bridge loans, mezzanine loans, and preferred equity. The platform also offers equity investments, including direct ownership of properties and investments in real estate funds.

RealtyMogul’s funds include a diversified commercial real estate fund and a multifamily value-add fund. One of the platform’s unique features is its Investor Advantage program, which offers certain investors additional benefits, such as access to exclusive deals.

RealtyMogul charges investors an annual management fee of 0.5% – 1.5% for its funds, as well as a performance fee of 10% – 15% for certain investments.

Conclusion

Real estate crowdfunding has opened up new opportunities for investors to access real estate deals that were previously unavailable. The four leading real estate crowdfunding platforms we discussed offer a variety of investment options. They include both debt and equity investments, allowing investors to diversify their portfolios across multiple properties and projects.

Each platform has its own unique features and fees, so it’s important for investors to do their due diligence before deciding which platform to invest in. With the right research and investment strategy, real estate crowdfunding can be a valuable addition to any investment portfolio.